Turn your software into a revenue engine

Transform your ISV or SaaS platform into a complete commerce solution. Aurora’s ARISE platform delivers integrated payments that drive customer retention, unlock new recurring revenue streams, and accelerate growth, all through a single API integration that scales alongside you.

Why leading ISVs choose integrated payments

Your customers rely on your software to run their business. Now you can help them get paid faster with a fully branded, ISV platform that works smoothly and generates new revenue for your SaaS.

- Flexible APIs

- White-Label Branding

- Payment Expert Support

- Simple Pricing

Flexible APIs

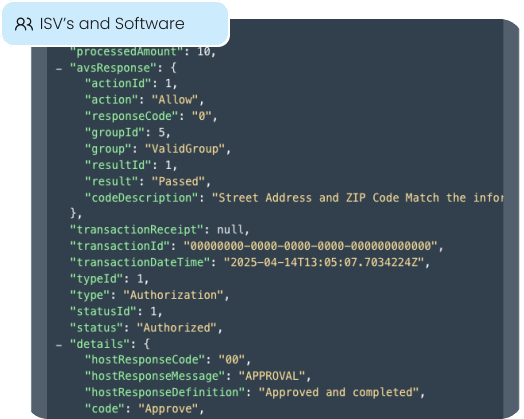

Connect once and access everything. Our RESTful APIs and SDKs give your development team the tools to support card payments, ACH, subscriptions, rewards, invoicing, and more. With clear documentation, real-time webhooks, and a live sandbox, building with Aurora is straightforward from the start.

White-label branding

Make every payment touchpoint look and feel like you. Your logo, your colors, your brand experience – across checkout screens, receipts, dashboards, and even statements. All while Aurora handles PCI compliance, fraud prevention, and everything else that comes with payment operations behind the scenes.

Payments experts

You’re never alone. You get a dedicated expert assigned to your account, plus a payments-led growth team to guide you through launch. But the real value comes after you go live–actively helping you boost payment attachment and recurring revenue.

Simple pricing

Transparent pricing for the win. Integrated payments generate additional recurring revenue while increasing customer stickiness. Our revenue-share model means predictable income that scales with your customer base, with no hidden fees or surprises.

Payments support built around your success

Skip the phone maze. Every Aurora ISV partner gets a named solutions engineer who understands your specific challenges and growth objectives. US-based technical support and direct access to our developer-to-developer Slack community. We track your success through quarterly growth reviews because we’re invested in your results–because when you grow, we grow.

Payments-led growth. Powered by ARISE.

Aurora’s ARISE platform is built from the ground up for ISVs and SaaS companies that demand enterprise-grade reliability, bulletproof security, and data that drives decisions. Whether you’re shipping your first payment feature or expanding across continents, we provide the technology, expertise, and support to accelerate revenue growth, without slowing your roadmap.

- Built for Developers

- Reduced Fraud

- Compliant Surcharging

- Real Time Reporting

- Flexible Payment Options

Built for developers

RESTful APIs, comprehensive SDKs, and real-time webhooks let your dev team integrate payment capabilities in days, not months. Detailed documentation and sample code accelerate development, while direct access to our engineering team through Slack means instant answers.

Reduced fraud

AI-powered risk scoring and real-time monitoring provide PCI DSS Level 1 coverage for your merchants while maximizing approval rates. And with network tokenization on ARISE, you can be worry free.

Compliant surcharging

Automatically calculate and disclose fees by card type, state, and channel. Dynamic signage, pass-through settings, and audit logs keep you 100% compliant while protecting margins for you and your merchants.

Best in class reporting

Granular transaction views, payout reconciliation, and interchange-level detail—instantly exportable via API or CSV. Custom dashboards surface ARPU, attach rates, and cohort churn so product and finance teams stay aligned.

Flexible payment options

Credit Cards, ACH, RTP, digital wallets, subscriptions, and Tap to Pay—whether customers shop online or walk through the door. One integration covers every payment method that matters, with automatic updates as new options emerge.

Delivering Real Results for High-Growth ISVs and SaaS Platforms

“Aurora listens, adapts, and builds solutions tailored to our needs, pulling everything together as an all‑in‑one platform. Their personalized attention and flexibility mean we never have to chase different rails or vendors. This approach delivers seamless, efficient payment operations—and we love it.”

-Don Bregin, Managing Partner

Tru Payments

FAQs

Q: What is “ISV integrated payments,” and why should I embed it?

Integrated payments let your platform own the entire checkout flow—boosting user stickiness, unlocking new recurring revenue, and giving you richer data. With Aurora, a single API call drops payments, onboarding, invoicing, and reconciliation directly into your product.

Q: How long does it take to go live?

Most partners complete sandbox testing, certification, and first live transaction in 10–20 business days. Our dev-to-dev Slack channel and sample code repos remove the usual back-and-forth.

Q: Do I need to become, or stay PCI compliant?

Aurora’s tokenization, hosted fields, and SAQ-A compliant components keep card data off your servers, reducing your scope to the lightest SAQ level. We also provide quarterly scans and audit documentation.

Q: How do revenue-share and pricing work?

You choose. Transparent interchange-plus pricing means no hidden “bill-back” fees for your merchants, and detailed payout reports reconcile every cent.

Q: How quickly can my merchants start accepting payments?

Our cloud boarding and auto-underwriting can approve and activate qualified merchants in under five minutes, cutting abandonment and accelerating your payment-attachment KPIs.

Q: Where do I go for ISV support?

Every partner gets a named solutions engineer, 24 / 7 U.S. ticketing, plus quarterly growth reviews to optimize attach rates and new-feature adoption.

Looking to become an ISV partner?

Join the ISVs already generating additional revenue through integrated payments. Our team will show you exactly how Aurora can accelerate your growth, improve customer retention, and unlock new revenue streams—without the complexity.